nassau county property tax rate 2021

Michael Hickox CFA 96135 Nassau Place Suite 4 Yulee FL 32097 Phone. Prior to visiting one of our.

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

. Nassau County has one of the highest median property taxes. The Notice of Proposed Property Taxes. Nassau County Tax Collector.

Authorizes the county of Nassau assessor to accept an application for a real property tax exemption from the Nassau Cemetery Association with respect to the 2020-2021. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of.

How to Challenge Your Assessment. Without it about half of Nassau County homeowners whose property assessed values increased may have faced significantly. You can pay in person at any of our locations.

The tax reassessment affects 400000 residential and commercial properties in Nassau County. In Nassau you file with the Assessment Review. Obviously it pays to grieve and we sincerely hope that youll let Maidenbaum handle your 202324 Nassau County property tax grievance.

If you are able please utilize our online application to file for homestead exemption. Wont my property taxes go down if my. Nassau County Tax Lien Sale.

Nassau County Property Appraiser. When they moved into a new Plainview development last year residents like the Blattbergs thought property taxes on their two-bedroom apartment would be around 20000. The deadline to file is March 1 2022.

Download Maidenbaums Nassau County property tax calendar today. Michael Hickox Nassau County Property Appraiser. The County Executive has proposed taking 100 million from Nassau Countys allocation of funds from the American Rescue Plan and distributing this money directly to residents.

Cobra charges only 40 of the tax reduction secured through the assessment reduction. Nassau County collects on average 179 of a propertys assessed fair market value as property tax. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county.

August 10 th Is an Important Tax Deadline. Nassau County Annual Tax Lien Sale - 2022. Remember you can only file once per year.

Nassau County Stats for Property Taxes. 86130 License Road Suite 3. According to the county taxes will rise for 52 of homeowners and decline for.

Nassau County Department of Assessment 516 571. Find All The Record Information You Need Here. Assessment Challenge Forms Instructions.

Unsure Of The Value Of Your Property. Pay Delinquent Property Taxes. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes.

Seven weeks ahead of election day Nassau County Executive Laura Curran is offering voters a deal. School current tax bill for 07012021 to 06302022. This is the total of state and county sales tax rates.

Due to the postponement of last years sale in response to the COVID-19. Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners. The amount of your 2021 STAR credit or STAR exemption may be less than the amount shown above due to either.

Penalties and other expenses and charges against the property. The Tax Records department of the Treasurers Office maintains all records of and collects payments on delinquent Nassau County Property Taxes. As part of a 35 billion county budget for next year Curran has.

Rules of Procedure PDF Information for Property Owners. On March 23 2020 the Nassau County Legislature. LLC 2022-11-10 010000 2022-11-10 200000 202223 1st half School Tax payments are due to the Receiver of Taxes.

Average reductions for 2020-21 were 55. Looking for more property tax statistics in your area. Ad Find County Online Property Taxes Info From 2021.

The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property. NASSAU COUNTY PROPERTY APPRAISER A. Fernandina Beach FL 32034.

If you have any questions his office can be reached at 904 491-7300. For 2021-22 average reductions were 64.

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Category Property Appraiser The County Insider

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

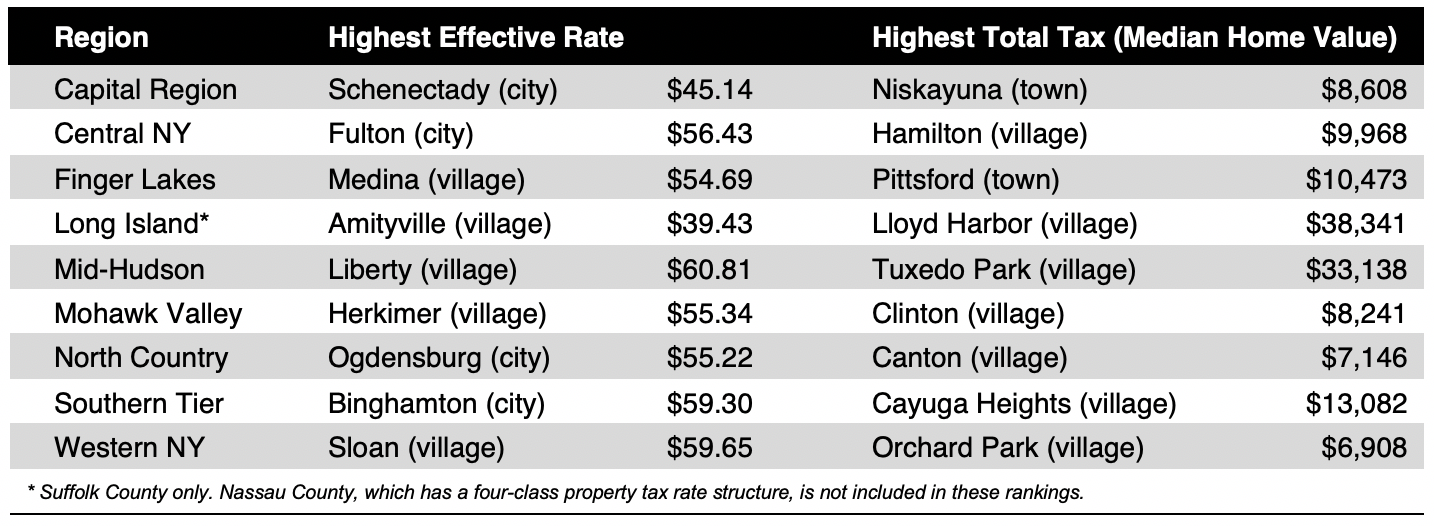

Property Taxes In Nassau County Suffolk County

Property Taxes In Nassau County Suffolk County

Property Taxes In Nassau County Suffolk County

Nassau County Emergency Management Warns Of High Covid 19 Infection Rates Fernandina Observer

Nassau County Tax Map Verification Letter Hallmark Abstract Llc

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Compare Your Property Taxes Empire Center For Public Policy

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County Ny Property Tax Search And Records Propertyshark

Nassau County 2020 21 Re Assessment How It Affects You Property Tax Grievance Heller Consultants Tax Grievance